If you’ve ever tried to ship something internationally, you probably know the stress of unexpected fees, delayed shipments, or a carrier saying, “Not my problem!” The good news? You can avoid these nightmares by mastering International Shipping Incoterms 2025—the internationally recognized shipping rules that define who’s responsible for what in a shipment.

When I first got into international shipping, I had no clue what Incoterms were. I just assumed, “Hey, if I ship something, it’ll get there, right?” Wrong. One time, I used the wrong Incoterm, and my goods got stuck at a port for two weeks. The customer was furious, I lost money, and I learned a hard lesson: Incoterms matter.

So, let’s break them down in a way that actually makes sense—real examples and no confusing jargon.

What are international shipping incoterms?

Incoterms (short for International Commercial Terms) are standardized shipping terms published by the International Chamber of Commerce (ICC). They define who’s responsible for the goods at each step of the journey—payment, insurance, customs clearance, and even risk of damage.

Why should you care?

– Avoid costly mistakes (hidden fees can destroy your profit margins).

– Protect your shipments (knowing who’s responsible for damages is a lifesaver).

– Keep your customers happy (no one likes waiting for a package stuck at customs).

According to the World Trade Organization, over 90% of global trade relies on Incoterms, making them one of the most essential tools for businesses involved in international shipping.

The History of International Shipping Incoterms

International shipping incoterms, or International Commercial Terms, were introduced by the International Chamber of Commerce (ICC) in 1936. They were designed to provide a common set of rules to clarify the responsibilities of buyers and sellers in international transactions.

Over the years, logistics terms have been periodically updated to reflect changes in global trade practices, with the latest version, Incoterms 2020, coming into effect on January 1, 2020.

International shipping incoterms and the ICC

The International Chamber of Commerce (ICC) is the guardian and publisher of the Incoterms of International Shipment rules and Shipment documentation. The ICC is a global business organization that represents companies of all sizes and sectors in over 130 countries. The ICC is responsible for updating and publishing the shipping terms rules, with the latest version being Incoterms 2020.

Why International Shipping Incoterms Matter (And How They Saved Me from a Costly Mistake)

Alright, let’s talk about something that might not seem sexy at first—but trust me, if you’re dealing with international trade, you need to know about Incoterms (International Commercial Terms). These little three-letter abbreviations could mean the difference between a smooth shipment and a total logistical nightmare.

How do I know? Well, let’s just say that one time, I almost ended up paying thousands of dollars in extra costs because I didn’t fully understand the Incoterm in my contract. More on that later.

1. My (Almost) Costly Incoterms Disaster

A few years ago, I was working with a supplier in China for an e-commerce business. We were importing kitchen gadgets (yes, one of those viral “life-changing” products). We agreed on an Incoterm: FOB (Free on Board).

I thought, “Cool, the supplier handles everything until the goods are on the ship. No problem.”

But here’s what I didn’t realize: Once those goods were on the ship, I was responsible for everything—freight, insurance, customs clearance, import duties… the whole package.

The shocker? The shipping company hit me with unexpected port handling fees that I hadn’t budgeted for. And trust me, those costs weren’t small. If I had chosen CIF (Cost, Insurance, and Freight) instead, the supplier would have covered the freight and insurance, making my life a lot easier.

Lesson learned: Always understand who pays for what before signing the contract.

2. Why This Matters for Your Business

If you’re importing or exporting, choosing the wrong Incoterm can eat into your profits—or even make your entire shipment unprofitable.

A 2023 study by Shipping and Freight Resource found that 38% of businesses faced unexpected shipping costs due to misunderstandings about Incoterms. That’s almost 4 out of 10 businesses losing money just because they didn’t know the rules!

And here’s the kicker: Most small business owners don’t even realize their mistake until it’s too late.

3. How to Avoid Costly Mistakes

Use Incoterm Tools – Websites like ICC’s Incoterms® rules page provide updated details on each term. Bookmark it. Seriously.

Read the Fine Print – Before agreeing on an Incoterm, double-check who is responsible for insurance, duties, and additional fees.

Negotiate with Your Supplier – If you’re a small business, suppliers may push EXW or FOB to shift costs onto you. But you can negotiate for CIF or even DDP if it works better for your budget.

Work with a Freight Forwarder – If this all sounds overwhelming, a good freight forwarder can handle the logistics and help you avoid costly mistakes.

Look, I get it. Shipping logistics aren’t exactly thrilling cocktail party conversation. But if you’re in the business world, knowing Incoterms is like having a cheat code for avoiding unnecessary costs and stress.

Overview of Changes from Incoterms 2010 to Incoterms 2020

The transition from Incoterms 2010 to Incoterms 2020 brought several notable changes:

Revised Terminology: The term “Delivered at Terminal (DAT)” was replaced with “Delivered at Place Unloaded (DPU)” to better reflect the delivery point.

Expanded Guidance: The Incoterms 2020 rules include more detailed explanatory notes and guidance to help users select the most appropriate term for their transaction.

Increased Focus on Security: The new rules place greater emphasis on security-related obligations, such as customs clearance and export/import requirements.

Refined Cost Allocation: The logistics terms 2020 rules provide a more comprehensive and transparent presentation of the costs associated with each term, helping to avoid confusion and disputes.

Differentiated Insurance Coverage: The rules for Carriage and Insurance Paid To (CIP) and Cost, Insurance, and Freight (CIF) now specify different levels of insurance coverage.

These changes in trade terms 2020 aim to provide greater clarity, flexibility, and adaptability to the evolving needs of international trade.

Detailed Explanation of Each Incoterm

Types of International Commercial Terms

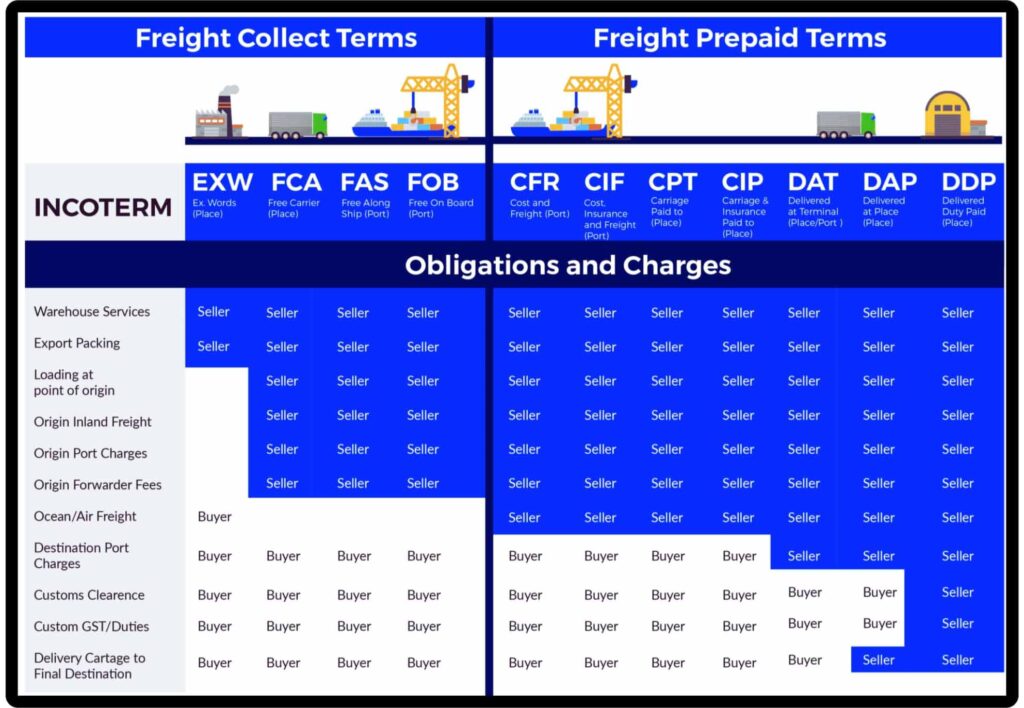

- Rules for any mode of transport: EXW, FCA, CPT, CIP, DAP, DPU, DDP.

- Rules for sea and inland waterway transport: FAS, FOB, CFR, CIF.

Incoterms in International Trades are divided into four main categories based on the first letter of the term:

E Terms (Departure Terms): EXW

F Terms (Main Carriage Unpaid): FCA, FAS, FOB

C Terms (Main Carriage Paid): CFR, CIF, CPT, CIP

D Terms (Arrival Terms): DAP, DPU, DDP

In-Depth Look at Each of the 11 Incoterms

1. EXW (Ex Works) – “You Handle EVERYTHING”

With EXW, the seller’s only job is to make the goods available at their warehouse or factory. You, the buyer, are responsible for everything—shipping, customs, insurance, import duties, and delivery.

💡 Real-Life Example:

I once worked with a client who bought industrial machinery from Germany under EXW terms. He assumed the supplier was handling export clearance (spoiler: they weren’t). His shipment got stuck at customs for three weeks because no one filed the paperwork, and he had to hire a third-party agent at double the cost to sort it out.

👉 Use EXW if:

– You have a trusted freight forwarder who can handle shipping.

– You want full control over logistics and costs.

❌ Avoid EXW if you’re new to international trade—there are too many moving parts, and one mistake can get very expensive.

2. FCA (Free Carrier) – “We’ll Deliver It to a Pickup Point”

With FCA, the seller is responsible for delivering the goods to a specified location (like a port, airport, or warehouse). After that, it’s your responsibility.

💡 Real-Life Example:

A friend of mine, Sarah, imported textiles from India. The supplier delivered the goods to a freight forwarder’s warehouse in Mumbai (FCA Mumbai), and Sarah’s shipping company took it from there. She loved this setup because it gave her more control over shipping costs while still avoiding the headache of picking up goods directly from the supplier.

👉 Use FCA if:

– You work with a third-party logistics provider (3PL).

– You want the supplier to handle export formalities but control shipping yourself.

3. CPT (Carriage Paid To) – “Seller Pays for Transport, You Handle the Rest”

Under CPT, the seller covers transport costs up to a specified destination, but risk transfers to you once the goods are handed over to the first carrier (usually at the port of departure).

📌 Example:

A client of mine once imported organic spices from India. The supplier offered CPT Hamburg, meaning they covered shipping to the port of Hamburg, but my client was responsible for customs, duties, and delivery to his warehouse in Berlin.

✅ Use CPT if: You think the seller will choose the cheapest, slowest shipping option (which happens more than you’d think).

❌ Avoid CPT if: You want the seller to arrange international transport, but you’re comfortable handling import clearance and local delivery.

4. CIP (Carriage & Insurance Paid To) – “Same as CPT, But With Insurance”

CIP is just like CPT, but with one key difference: the seller is required to buy insurance that covers the goods up to the named destination.

📌 Example:

A friend of mine imported medical equipment from Japan using CIP Los Angeles. The supplier not only covered the shipping costs but also insured the shipment, so when one box was damaged in transit, the insurance company paid for a replacement.

✅ Use CIP if: You already have your own cargo insurance policy (you might end up overpaying).

❌ Avoid CIP if: You want extra security in case your goods get damaged in transit.

5. DAP (Delivered at Place) – “We’ll Deliver It, But You Handle Customs”

The seller delivers the goods to your final destination, but you are responsible for import duties and customs clearance.

💡 Real-Life Example:

I once imported coffee beans from Colombia. The supplier shipped the beans directly to my warehouse (DAP New York), but I had to pay import duties and file customs paperwork. The process was smooth—except for the surprise tax bill. 😬

👉 Use DAP if: You want a hassle-free shipping process but have a customs broker to handle import duties.

6. DPU (Delivered at Place Unloaded) – “We’ll Deliver It AND Unload It for You”

DPU is the only Incoterm where the seller is responsible for unloading the goods at the final destination. Previously called DAT (Delivered at Terminal) in Incoterms 2010, this term is great for buyers who don’t want to deal with unloading logistics.

📌 Example:

A company I worked with imported heavy machinery from Italy. They chose DPU Chicago, which meant the supplier arranged shipping and unloading at their warehouse. This saved them thousands in forklift rental and labor costs.

✅ Use DPU if: Your location doesn’t have the right equipment or manpower to receive the shipment (you don’t want your goods sitting at the port for days).

❌ Avoid DPU if: You don’t want to deal with unloading costs or logistics.

7. DDP (Delivered Duty Paid) – “The Seller Handles EVERYTHING”

DDP is the most buyer-friendly Incoterm. The seller takes care of shipping, insurance, customs, and delivery to your doorstep.

💡 Real-Life Example:

A client of mine sells Italian wine online. She only works with suppliers who offer DDP because she doesn’t want to deal with customs paperwork. Her suppliers deliver directly to her fulfillment center without any hidden fees.

👉 Use DDP if: You want a stress-free experience with no surprise costs.

❌ Avoid DDP if: The supplier inflates shipping and duty costs (which some do). Always compare prices!

8. FAS (Free Alongside Ship) – “We’ll Get It to the Port, You Handle the Rest”

With FAS, the seller delivers the goods next to the ship at the port, but you are responsible for loading it onto the vessel, insurance, and everything afterward.

📌 Example:

A seafood exporter in Canada used FAS Vancouver to send fresh lobster to China. The seller delivered the goods next to the cargo ship, but the buyer arranged the loading, shipping, and import clearance.

✅ Use FAS if: You work with a freight forwarder who can handle ocean transport.

❌ Avoid FAS if: You don’t want to deal with port loading fees and export logistics.

9. FOB (Free on Board) – “You Take Over After It’s on the Ship”

The seller is responsible for getting the goods onto the ship, but after that, it’s your responsibility.

💡 Real-Life Example:

I once helped a client import ceramics from Thailand. Using FOB Bangkok, the supplier handled export clearance and loaded the goods onto a vessel. My client paid for ocean freight, insurance, and final delivery.

👉 Use FOB if:

– You want more control over freight costs.

– You have a trusted shipping partner.

10. CFR (Cost & Freight) – “We’ll Pay for Shipping, But You Handle Risk”

CFR is like FOB, except the seller also pays for ocean freight to the destination port. However, risk still transfers to the buyer once the goods are loaded onto the ship.

📌 Example:

I once helped a client import furniture from Vietnam. They chose CFR New York, so the supplier covered ocean freight, but once the cargo left Vietnam, my client was responsible for insurance, customs, and delivery. Unfortunately, one container was lost at sea, and they had no insurance—a costly mistake!

✅ Use CFR if: You need insurance (because under CFR, it’s NOT included).

❌ Avoid CFR if: You want the seller to cover ocean freight, but you’ll handle insurance and final delivery.

11. CIF (Cost, Insurance, and Freight) – “We’ll Ship It, But It’s Your Risk After the Port”

CIF means the seller pays for shipping and insurance up to the destination port, but once it arrives, you’re responsible for customs, duties, and final delivery.

💡 Real-Life Example:

A business partner of mine imported electronics from China using CIF Los Angeles. The supplier covered ocean freight and insurance, but once the shipment arrived, he had to handle customs clearance and trucking to his warehouse.

👉 Use CIF if: You want the seller to handle ocean shipping and insurance but are comfortable managing import duties and final delivery.

Specific Responsibilities and Obligations of the Buyer and Seller for Each Term

Alright, let’s get real—nothing ruins a deal faster than someone dropping the ball on their responsibilities. Whether it’s in international trade, freelancing, or even splitting the bill at dinner, unclear responsibilities can lead to frustration, lost money, and some serious trust issues.

I learned this the hard way when I first started handling international shipments. A small misunderstanding about who was responsible for customs clearance cost me weeks of delays and a bill I wasn’t expecting. (Spoiler alert: it was not a fun surprise.)

So, whether you’re running a business, managing a project, or simply trying to get your fair share of pizza, understanding responsibilities and obligations is non-negotiable. Let’s break it down with some real-world scenarios.

1. Why Responsibilities and Obligations Matter (AKA The Difference Between Success and Chaos)

Think about it. Have you ever been part of a group project where one person slacked off, forcing everyone else to pick up the pieces? That’s what happens in business when responsibilities aren’t properly assigned.

According to a study by Harvard Business Review, nearly 70% of project failures are caused by unclear roles and responsibilities. That’s right—most failures don’t happen because of bad ideas but because people weren’t sure who was supposed to do what.

Now, let me share how I almost learned this the hard way.

2. Allocation of transportation costs: The “Who Pays for This?” Nightmare (A True Story)

A few years ago, I was importing kitchen products for an e-commerce business. I had a supplier in China, a shipping company, and a customs broker. Everything seemed smooth—until my shipment landed at the port.

I got a call:

“Your shipment is here, but customs duties haven’t been paid. That’ll be $5,000.”

Wait, what? I thought my supplier had covered that. Turns out, we had agreed on FOB (Free on Board) terms, which meant once the goods were on the ship, the responsibility shifted to me. I hadn’t factored that cost into my pricing, which cut deeply into my profit margins.

Lesson learned: Always clarify responsibilities upfront.

If I had negotiated DDP (Delivered Duty Paid) terms, the supplier would have handled everything—customs, duties, shipping—all the way to my warehouse. It would have cost more upfront, but it would have saved me from that surprise $5,000 bill.

3. Responsibility for insurance and customs duties Checklist (So You Don’t Get Burned)

When dealing with any business transaction, make sure these responsibilities are 100% clear:

✅ Financial Responsibilities:

– Who pays for shipping, insurance, and duties?

– Are there hidden fees? (Trust me, there usually are.)

– Is payment upfront, in installments, or on delivery?

✅ Legal & Compliance:

– Who’s responsible for customs paperwork?

– Does the contract clearly state what happens if something goes wrong?

– Are there government regulations that need to be followed?

✅ Risk Management:

– Who’s liable if the goods are damaged in transit?

– Is there insurance? Who pays for it?

– What happens if there’s a delay?

4. How to Protect Yourself (And Your Business)

– Put Everything in Writing – A handshake agreement might feel good, but if there’s no written record, it’s your word against theirs. Always document responsibilities in a contract, email, or at least a WhatsApp message.

– Use the “Worst-Case Scenario” Test – Ask yourself: If something goes wrong, do I know exactly who’s responsible? If the answer is “not sure,” then clarify it now.

– Negotiate Before You Sign – You have more power than you think. If something feels unfair or unclear, speak up before you agree—not after.

– Learn from Other People’s Mistakes – There are thousands of horror stories about unclear responsibilities in business. Read them. Learn from them. And don’t be the next one.

Once you start setting clear expectations, you’ll save money, avoid stress, and earn the respect of your clients and partners.

So next time you’re about to enter into a deal, ask yourself:

✔ Do I know exactly who’s responsible for what?

✔ Is it in writing?

✔ What’s the worst-case scenario, and am I covered?

If the answer to any of those is “no”—fix it now, before it’s too late.

Because trust me, it’s a lot cheaper to clarify responsibilities upfront than to pay for mistakes later.

Commonly Used Incoterms for Different Types of Goods and Shipping Methods

Bulk goods: FOB, CIF

Manufactured goods: EXW, DAP

Consumer goods: FCA, CPT

Choosing the Right Incoterm for Your Shipment

Here’s a quick cheat sheet:

✅ If you’re a beginner: Go for DDP (everything is handled for you).

✅ If you want control over shipping costs: Use FOB or CIF.

✅ If you’re a supplier with international buyers: EXW or FCA might be best.

💡 Pro Tip: Work with an experienced freight forwarder who understands Incoterms. It’s an investment that prevents costly mistakes!

Factors to Consider When Selecting Logistics Terms

–Nature of the goods

–Transportation mode

–Cost implications

–Risk management preferences

–Legal and regulatory requirements in both countries

How International Shipping Incoterms Affect Customs and Duties

Incoterms play a crucial role in determining the responsibilities and obligations related to customs clearance and the payment of import duties and taxes.

Incoterms and Customs Clearance

The choice of trade terms directly impacts the party responsible for customs clearance and the associated costs. For example, under the EXW term, the buyer is responsible for handling the export and import customs clearance.

While under the DDP term, the seller is responsible for both. Understanding the customs clearance responsibilities defined by the commercial terms can help businesses plan their supply chain operations more effectively, minimize delays, and ensure compliance with relevant regulations.

Incoterms and Import Duties

Incoterms in International Trade selected also influence the party responsible for paying import duties and taxes. In general, the party that takes ownership of the goods at the point of delivery (as defined by the trade terms) is also responsible for paying the applicable import duties and taxes.

For example, under the DAP term, the seller is responsible for delivering the goods to the named place and clearing them for import, which includes paying any import duties and taxes. In contrast, under the EXW term, the buyer is responsible for the import clearance and the associated duties and taxes.

By understanding the impact of commercial terms customs and duties, businesses can better plan their cash flow, optimize their supply chain costs, and ensure compliance with trade regulations.

Final Thoughts (Learn From My Pain!)

Shipping internationally isn’t just about slapping a label on a box and hoping for the best. The right International Shipping Incoterm can save you thousands of dollars, reduce stress, and make sure your business runs smoothly.

I’ve made my fair share of mistakes—choosing the wrong term, assuming customs would be “easy,” and dealing with furious customers because I didn’t understand who was responsible for what. But now, I know better.

So before you make your next international shipment, take a minute to choose the right Incoterm. Your future self (and your bank account) will thank you.

Need logistics service or support? Contact us—we’d love to help you anytime.

FAQ

Q1. What is the main purpose of international shipping incoterms?

A1. The primary purpose of Incoterms is to provide a standardized set of rules that define the responsibilities and obligations of buyers and sellers in international trade transactions. Incoterms help to minimize misunderstandings, reduce disputes, and ensure smooth and efficient transactions between trading partners.

Q2. How often are Incoterms updated?

A2. International Commercial Terms are updated approximately every 10 years to reflect changes in trade practices and logistics. The latest update was in 2020.

Q3. What is the difference between CIF and FOB?

A3. CIF (Cost, Insurance, and Freight) means the seller covers the cost of goods, transport, and insurance up to the destination port. FOB (Free on Board) means the seller’s responsibility ends once the goods are on board the ship.

Q4. What is the difference between DPU and DAP?

A4. DPU (Delivered at Place Unloaded) means the seller is responsible for delivering and unloading the goods at the named place. DAP (Delivered at Place) means the seller delivers the goods ready for unloading at the named place, but the buyer is responsible for unloading.

Q5. What are the risks of using EXW for international shipments?

A5. Using EXW (Ex Works) for international shipments can pose risks for buyers, as they assume all responsibility for transportation, export procedures, and customs clearance. This can be challenging for buyers unfamiliar with the export country’s regulations.